A quick guide to life insurance types

Level Term Life Assurance is perhaps one of the most straightforward types of life assurance available. Level term means that if you need to make a claim, the sum assured will not vary during the term of the policy.

What should I know about Level Term Life Assurance?

Unlike other types of cover, the sum assured (the amount the policy will pay out) is agreed at the beginning of the policy remains the same throughout the term of the policy. The policy is set for a fixed numbers of years and the sum assured in the event of your death will not change.

Level Term Life Assurance can cover you for the term of your mortgage and beyond.

Knowing that your mortgage will be paid off in the event of your death gives you peace of mind and could help towards securing your family’s financial future. You can decide exactly how much cover you need you need, this can include your mortgage, existing debts and you can opt for additional cover to allow your family to continue to enjoy the standard of living they are used to, this could include lifestyle choices and future University fees.

Keeping pace with inflation.

Let’s assume that you need a level term policy to cover your mortgage and family for £200,000 in today’s money. If you make a claim some 20 years later, once your mortgage is paid off, will the remaining balance be sufficient to meet your family’s needs? You can index link your policy and premiums from the outset, you can link the sum assured to the Retail Price Index so as inflation increases the sum assured increases, and this guarantees that your policy retains its value.

Why choose this type of assurance?

If you’re a homeowner with a mortgage and financial dependants, Level Term Assurance should be considered as your minimum requirement for protecting your mortgage and family. The sum assured is fixed and the monthly premiums will not change through the term of the policy unless you opt for index linking your premiums.

Are there any other considerations with this type of policy?

In simple terms, the policy will have a fixed term and once the term has expired, your policy will be cancelled. If you still require life Assurance at this stage, you will need to consider that you will be older and you may have health issues that could increase your premiums if you decide to take out a new policy.

We never forget the detail!

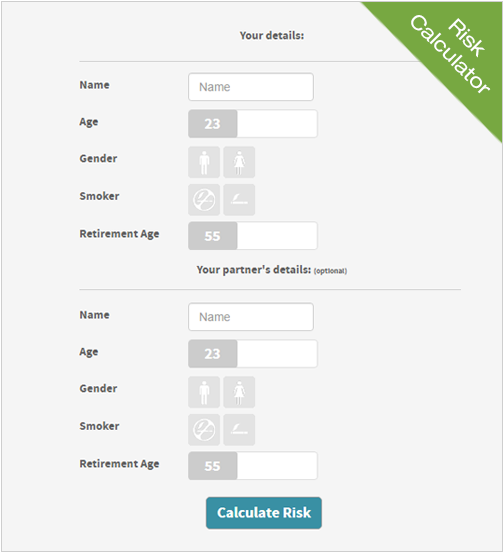

At Blueberry, our Consultants are qualified and trained to all aspects of Life Assurance. We will carefully review your personal circumstances now and your aspirations for the future. We will make a recommendation that gives you the peace of mind and the security your family and loved ones need.

Mortgage life Assurance is designed to pay off your mortgage balance in the event of your death. This means that should the policy holder die, the policy will pay off the outstanding mortgage balance.

Who needs mortgage life assurance?

If you have a mortgage and financial dependants, you need mortgage life assurance. This type of policy will pay off your remaining mortgage balance in the event of your death. Should you die during the term of your mortgage, you can’t just assume that your spouse or partner can just carry on making the mortgage payments even if they can afford to do so. Unless the mortgage was arranged in joint names, the lender could formally demand that the mortgage is repaid.

By arranging mortgage life assurance, this type of policy can guarantee to pay out enough to repay your mortgage balance in full.

Is mortgage life Assurance different to Term Assurance?

Yes, term assurance is usually level term, so the policy will pay out the same amount regardless of when a claim is made. With mortgage life assurance, this type of policy is usually decreasing term and is suitable for repayment mortgages. With decreasing term assurance, as your mortgage balance decreases year on year so does the sum assured. This type of policy can come with a mortgage guarantee that promises to pay the remaining mortgage balance regardless of future interest rate changes.

The advantage of this policy is that the premiums are cheaper compared to level Term Assurance.

Do I need mortgage life assurance?

You will need to consider whether or not your dependants would have sufficient capital to repay the mortgage in the event of your death. For the majority of us, the simple answer is no.

You will also need to consider that even if your dependants could pay the mortgage off in the event of your death, they will have also lost your income; this could have a huge effect on their finances going forward.

We never forget the detail!

At Blueberry, our Consultants are qualified and trained to all aspects of Life Assurance. We will carefully review your personal circumstances now and your aspirations for the future. We will make a recommendation that gives you the peace of mind and the security your family and loved ones need.

With whole of live cover, the guaranteed sum assured is paid out of the death of the policy holder; this cover is more expensive than Term Assurance because a death claim is certain to occur.

An agreed proportion of your monthly premiums are invested by the Assurance company and the returns help to fund the final pay out. Subsequently, both the monthly payments and the sum assured payable on death are subject to review and change.

The two main types of whole of life Assurance are ‘balanced cover and ‘maximum cover’.

About Whole of Life Assurance

Whole of Life Assurance is the only type of life cover that will guarantee to pay a lump sum on your death. This is because it is the only type of policy that guarantees to remain in force (providing you continue to pay the premiums) for the rest of your life.

Whole of Life Assurance or Assurance

The word "assurance" is used for policies that are guaranteed to pay-out provided the premiums are paid. The only type of policy that fits this strict definition is Whole of Life Assurance as this continues until you die, whenever this maybe - so to call it "Whole of Life Assurance" is technically incorrect!.

The word Assurance is used for policies which will pay-out only in certain circumstances, which means if you die during the policy term. If you outlive the term there is no pay-out (like a car Assurance that only pays out on an accident or theft)..

Uses for Whole of Life Assurance

Providing your loved one(s) with a lump sum on your death

If you die your partner may need a cash sum to help pay the bills and replace any lost income you may have. Whole of Life Assurance can provide this valuable peace of mind

Providing a lump sum to pay for your funeral and to pay off loans

The average cost of a funeral is around £7,300. We can provide the peace of mind that your loved ones won’t be left with this bill to pay after you have passed away.

Providing a lump sum to pay an Inheritance Tax bill

This could mean that assets which could include the family home don’t have to be sold to realise the cash required to pay the Inheritance Tax. The Inheritance Tax rate is 40% and this is charged on all estate assets in excess of the nil rate band, which is currently £325,000 for a single person

Family Income Benefit

cover

Family Income Benefit is an innovative type of life assurance designed to give your dependants a tax free, monthly income in the event of your death.

Who should consider Family Income Benefit?

This policy is suitable for couples who rely on each other’s income and who have young families or have older financially dependent children. Even if you are single and have no financial dependents, you may want to provide an additional financial security for your parents in their later life.

The main difference between Family Income Benefit compared to Term Assurance or Mortgage Life Assurance is that this policy rather than pay out a lump sum on your death, will pay out a monthly tax free income for the term of the policy.

Term Assurance or Mortgage Life Assurance is designed to pay off your mortgage, but if the worse happens have you considered how your dependents will manage without your income after your death.

How does Family Income Benefit work?

At Blueberry we will review your current income and expenditure now and assess your income requirements for the future. We will then recommend an annual sum assured; this is amount the policy will pay out each year for the remainder of the term. Payments can be made monthly and are tax free.

Keeping pace with inflation

Let’s assume that you need a Family Income Benefit Policy that will pay your financial dependants £3,000 a month in today’s money. If your family made a claim 20 years later, would £3,000 be enough? You can index link your policy and premiums, from the outset, you can link the sum assured to the Retail Price Index, so as inflation increases, the sum assured increases, and this guarantees that your policy retains its value.

Can my dependants choose to take a Capital Sum?

Yes, if your dependents decide that a capital sum would be better that receiving a monthly income, they can request that the policy is changed after your death.

Are the monthly premiums more expensive?

Compared to Level Term Assurance and Mortgage Life Assurance, the monthly premiums for Family Income Benefit are generally less expensive.

Can you think of a friend or a family member who has become seriously ill, how about a friend of your parents? One in five of us will suffer a critical illness.

Most of us think that the good health we enjoy now will stay with us forever. Unfortunately, statistics suggest the odds are stacked against us. Statistics confirm that one in five males and one six females will suffer a serious medical complaint at some stage in their life.

What is a Critical Illness?

Each Assurance company provides comprehensive definitions of what they include as a Critical Illness. Please don’t confuse Critical Illness with Terminal Illness. Level Term Assurance and Mortgage Life Assurance includes Terminal Illness cover at no addition cost. If you have a Terminal Illness, this means that you will not recover from the illness and your doctor or consultant have confirmed that your lifespan can be counted in weeks or months rather than years. In these circumstances, your policy could pay our on diagnosis of your Terminal Illness. With a Critical Illness, with ever advancing medical science, you have an ever improving chance of surviving a Critical Illness. Illness’s such as breast or testicular cancers are now curable in many cases but are still considered to be a Critical Illness.

Critical Illness Cover is designed to pay a capital sum or monthly income once you are diagnosed with a Critical Illness allowing you have financial peace of mind whilst focusing on getting back to full health.

We never forget the detail!

At Blueberry, our Consultants are qualified and trained to all aspects of Life Assurance. We will carefully review your personal circumstances now and your aspirations for the future. We will make a recommendation that gives you the peace of mind and the security your family and loved ones need.