Choosing the right life insurance policy requires time and knowledge. Otherwise you could end up with a policy that is not suitable for your short, medium and long term needs. Worse still, you could be refused a policy due to life style or health problems or buy a policy which may not pay out. This can happen if you make a mistake when applying for your policy. Making such a mistake can be very costly and stressful for you, your family or business partners.

At Blueberry, we have the expertise to help you make the right decision by giving you the knowledge you need. Our highly qualified and experienced life insurance Consultants will help you work out the best type of policy for you and tailor it to your needs and pocket.

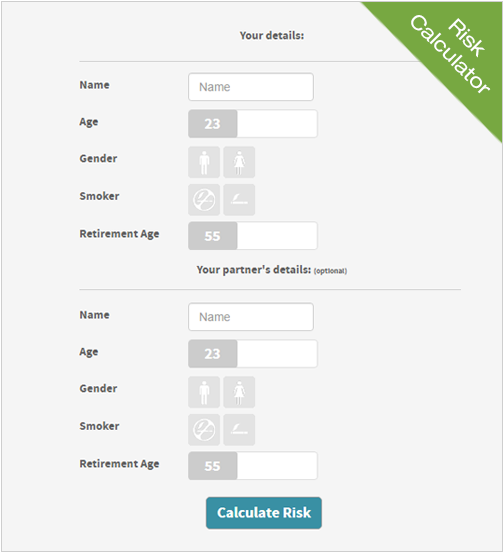

We will begin by getting a full understanding of what you want to achieve. It’s important to help you understand how much cover you need, what types of policy are available, which options are best to meet your needs and what premium is affordable for you right now. It’s also important to help you consider how your circumstances can change in the future. Because we are a whole of market broker, we can look at every type of life insurance policy from all available life insurance companies in the UK. We will have a constructive discussion to give you the knowledge you need in plain English.

We can even find a specialist company for you if you have health problems, have a high-risk job or have a hazardous leisure activities.

Call for a free consultation with one of our highly qualified life insurance protection Consultants.

Once you have decided on the policy you need, we will take you through the whole application process. There will be a series of detailed medical questions to make sure the insurance company is prepared to accept your risk. If you are in good health, you can be covered immediately.

If you are taking medication or have a medical history, our Consultants are trained to help you define your medical conditions and treatment accurately and openly for the insurer. Our Consultants also know which insurers are most competitive and able to cover certain medical conditions.

We pride ourselves on getting it right first time. Getting it wrong could mean a life insurance claim being rejected leaving your next of kin or business partners being severely disadvantaged following your death.

You may be surprised to learn that the people you want to benefit from your policy may not receive what they expect? You may also change your mind on who you want to benefit for your life insurance policy in the future.

Although the benefits of life insurance are tax free, when added to the value of your property and savings, part of your estate could become liable to Inheritance tax of 40%. Blueberry can help you and your family by putting your policy in trust.